FARM CASH MOVES FORWARD

BY IAN DOIG

Paperwork can be a burden. Shrinking the load and improving the cash advance user experience was part of the drive to create the Alberta Wheat Commission’s (AWC) FarmCash program, which launched in September 2018.

“Our goal was to administer an easy and convenient cash advance program and deliver it online while leveraging new technology,” said Syeda Khurram, FarmCash chief operating officer.

AWC offers FarmCash as an official administrator of the Advance Payments Program, a federal loan guarantee program that provides farmers with low interest operating loans.

Through this cash flow management tool, Alberta farmers gain improved flexibility, allowing them to sell their commodities when market prices are favourable, rather than when cash is needed for inputs. FarmCash offers farmers an advance of up to $1 million, with the first $100,000 being interest free on all commodities and $500,000 interest free on canola advances. The special interest free portion for canola applies to the 2019 program year only and is offered in response to China’s embargo on Canadian canola exports. FarmCash offers a low interest rate of prime-minus 0.5 per cent on the interest-bearing portion.

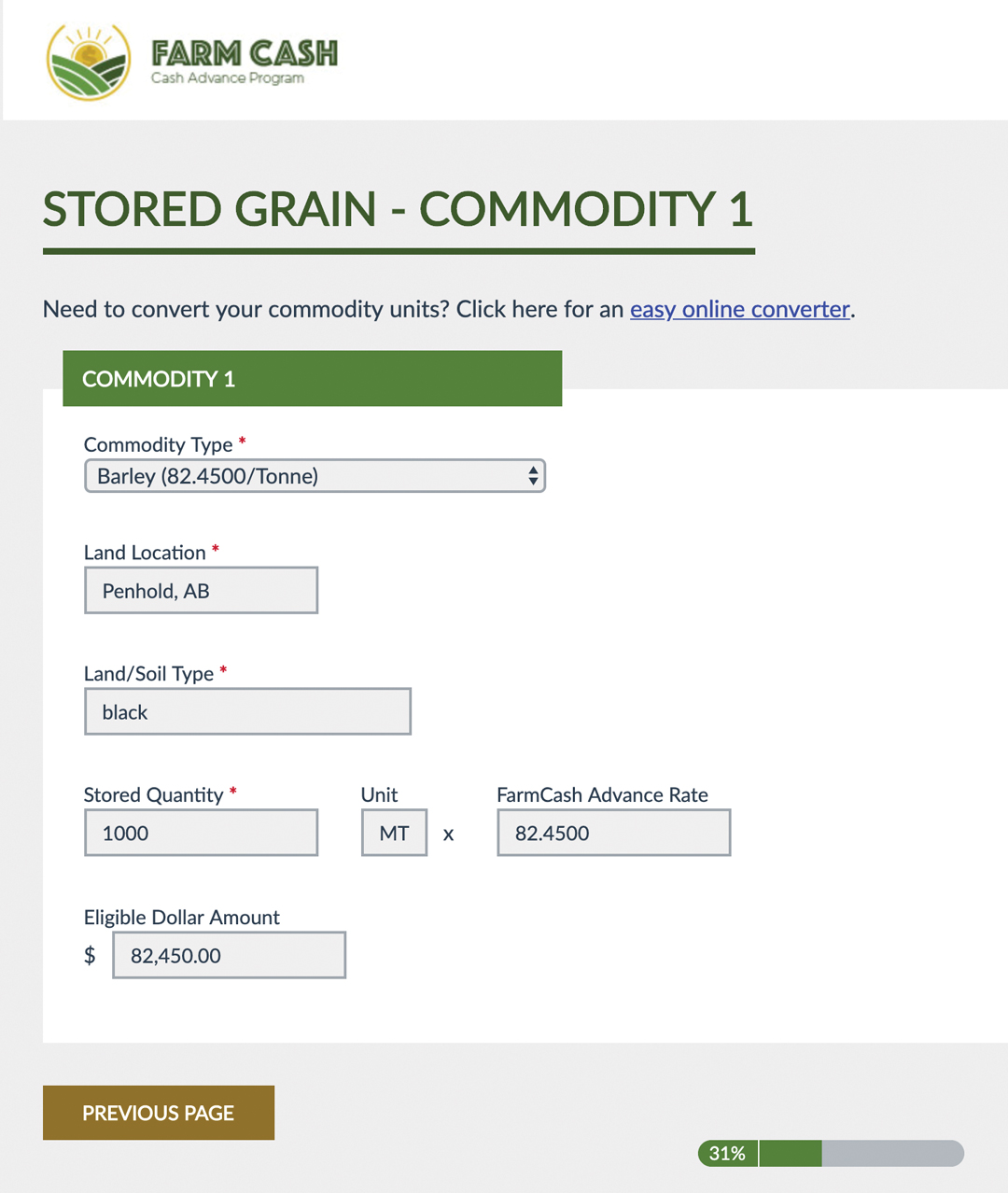

The program is open to farmers, ranchers and beekeepers. The updated online form launched in May 2019 adapts as the applicant answers the questions it poses, filtering out those that don’t apply to them, given their specific commodity area, credit history and insurance type. “This is a huge time-saving feature for farmers,” she said.

Further time-saving elements include e-signature capabilities and the ability to upload any required external support documents. The FarmCash platform also calculates applicant loan amounts. “These online features are not offered in any other cash advance programs,” said Khurram.

On the strength of its work for the banking and finance industries, AWC looked to the McCann Canada marketing and communications agency to bring the FarmCash online application process to life.

Lisa Gacek, digital group account director for McCann, said the agency’s goal was to make the online application reflect the strengths of the FarmCash program as a whole. “It was designed to be simple, easy and memorable. This is the same experience our team wanted every user to have during their online journey with FarmCash. We are constantly looking to ensure the user experience is friendly,” she said of the process of creating the online application.

Easy to get started and to navigate, the platform is also secured against unauthorized access. Other cash advance applications require a waiting period for login to be verified or have no online version. FarmCash applicants are shown only the fields that are relevant to them. Additionally, the calculation of qualifying funds is automatically completed. Entering acres or number of livestock, the system will display potential qualifying amounts. Users can also complete a portion of the application, log out and return to finish it later without restarting the procedure.

During the program’s first year, 30 per cent of applicants were first-time users. Applicants have reported they’re pleased the application process is not as demanding as with other cash advance programs they’ve used in the past. “They just hit the submit button and it’s gone. It’s our responsibility to process from there,” said Khurram.

She also noted that AWC will continue to monitor the effectiveness of both the program and its online form and strive to improve the advance process for both farmers and the elevators that process farmer repayments.

“We’re confident that FarmCash is a unique online platform that will attract farmers who are looking to create efficiencies within their operations,” said Khurram.

Comments