LIVING PROOF

BY MELANIE EPP • PHOTO: NICOLE MURRAY PHOTOGRAPHY

There is growing interest among farmers on the use of biostimulants to boost crop yield and quality. But with curiosity comes skepticism, as limited data on their effectiveness is available. To dispel some of the mystery around these potentially powerful tools, we spoke with companies now developing biostimulants, researchers who aim to quantify their efficacy and farmers who have adopted them in crop management systems.

WHAT ARE BIOSTIMULANTS?

Companies that market products in this relatively new input category have made many claims about the power of biostimulants. Farmers have been told they will boost crop yield and quality, as well as decrease reliance on conventional fertilizers. It has also been claimed biostimulants can improve plant tolerance to abiotic stress.

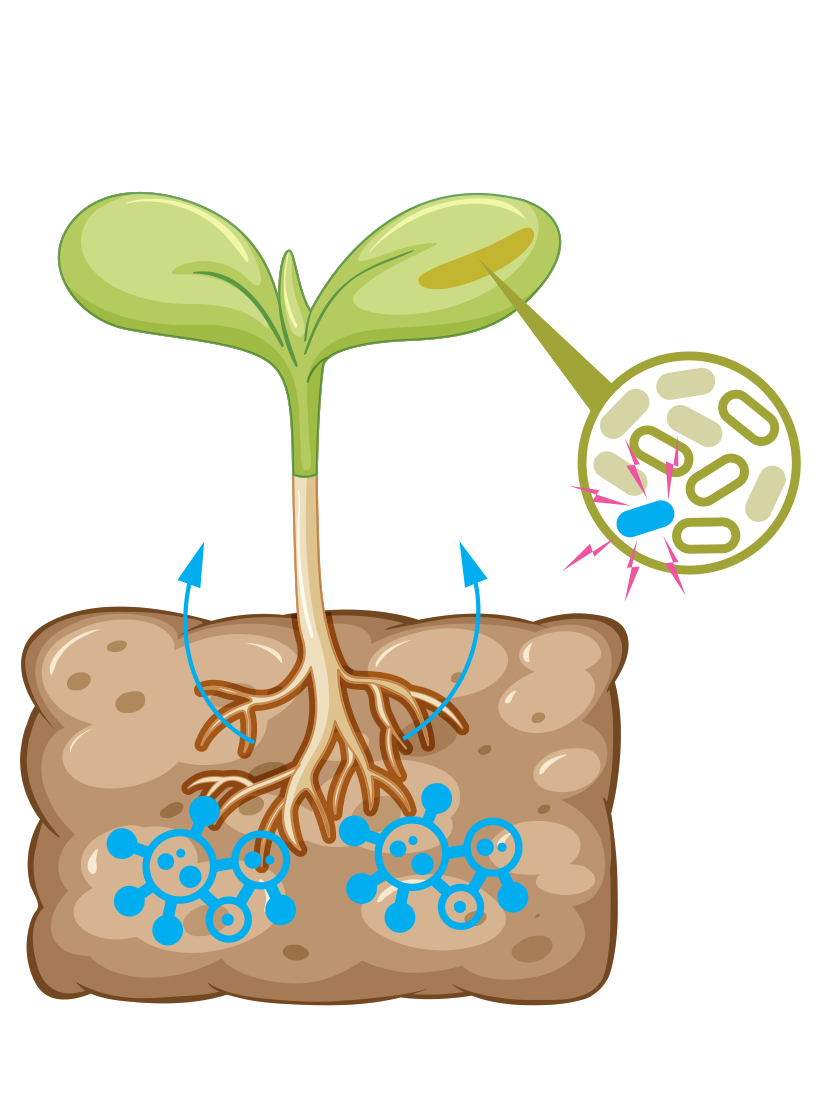

This despite the fact there is little consensus on the definition of the term “biostimulant.” Perhaps the best description is they are biological agents in the form of micro-organisms or plant extracts that, when applied to seeds, plants or soil, stimulate existing biological and chemical processes in the soil. Biofertilizers, on the other hand, are made of materials of biological origin, including plants and seaweed. According to Doug Grandel, Western Saskatchewan territory manager for OMEX Agriculture, the main difference between the two is biostimulants don’t contain nutrients, while biofertilizers do. That is, biostimulants are not fertilizers, pesticides or biocontrol agents.

No matter their form, biostimulants are expected to do big business in coming years. Market research company The Brainy Insights expects the global biostimulant market to grow from US $3.13 billion and surpass $7.63 billion by 2030. This predicted growth includes use in the ornamental plant, turf, fruit and vegetable sectors.

AGRIBUSINESS GIANTS INVEST BIG BUCKS

Key players in the biostimulant market include agribusiness giants Corteva and Syngenta. Both launched nutrient efficiency biostimulants in recent years. Corteva launched Utrisha N in November 2021, while Envita will be available from Syngenta for the 2023 growing season.

Utrisha N is a foliar-applied natural bacteria product Corteva classifies as a nutrient deficiency biostimulant. The bacteria fixes nitrogen from the air and converts it into a usable form for the plant, resulting in a constant supply of nitrogen to the plant. “The idea is to provide the nitrogen the plant needs, but also when that plant needs it,” said Kirsten Ratzlaff, product manager for seed-applied technology, fungicides and nutrient management at Corteva Agriscience Canada.

To determine how Utrisha N works in the field, Corteva ran two large-scale demo programs over the last two seasons that utilized more than 100 plots across Western Canada. Most trials included wheat and canola. “Nitrogen was not the yield-limiting factor in 2021,” said Ratzlaff, of the year’s drought conditions. “But we still saw really promising yield results when you look at the whole program.” Corteva’s 2022 program was even larger. The data is still coming in, but Ratzlaff is optimistic about yield results given plots were grown under better conditions.

Syngenta plans to launch a similar biofertility product in Canada in 2023. Envita is a nitrogen-fixing bacteria product that contains Gluconacetobacter diazotrophicus, a food-grade bacteria. Bacteria begin fixing nitrogen from the air within seven to 14 days after application, which can be done in-furrow or as a foliar treatment, said Brady Code, Syngenta Canada technical lead. As with Utrisha N, the process is intended to provide the plant with an additional source of nitrogen as needed throughout the season. Envita is registered for use on a broad range of row crops including corn, canola, cereals and soybeans.

Field-scale trials have been conducted across Canada over the last two years. The trials saw positive, neutral and negative results, which helped in the development of best management practices for farmers who apply Envita, according to Code. In some cases, no noticeable differences were observed, especially where nitrogen from manure was readily available in the soil.

“But in the field that … did not have a history of hog manure, Envita showed a significant response within the crop,” said Code. The field saw a five- to six-bushel yield response, he added. The eventual intent is farmers will be able to use Envita to help meet the nitrogen requirements of their crops and with experience adjust their fertilizer program accordingly. “But we’re not at that stage right now,” said Code. There is not yet a way to confirm the bacteria has indeed colonized the plant, but Syngenta is working with researchers to devise a method.

INDEPENDENT FIELD TRIALS

Over the last two summers, independent agronomists have conducted field trials in Alberta that compared yield and quality data in treated and untreated fields of CPSR, CWRS and durum wheat. For the most part, their results were underwhelming. For instance, Jeremy Boychyn, agronomy research extension specialist for the Alberta Wheat Commission (AWC) and Alberta Barley, conducted trials on four farms this past summer. Three compared results of Utrisha N and Envita, while one trial looked at Utrisha N only.

Product was foliar applied at herbicide timing at the five- to six-leaf stage when the wheat had two to three tillers. In each case, the farmer worked directly with a professional agronomist to ensure product was properly mixed and applied. Boychyn said they avoided tank mixing with herbicides in case it had a detrimental effect on the biostimulant being tested. All trials were replicated and randomized at least four times.

Product cost per acre was $12.50 for Envita, and $12.95 for Utrisha N. Actual cost of application will depend on whether or not farmers include the product in the same pass as their regular herbicide application. To make a return on investment, a farmer would need a one to 1.5 bu/ac yield bump. Across the board, though, Boychyn said no significant differences in yield or quality were observed.

“It’s unfortunate we saw the results we did,” said Boychyn. “I think there is a desire from farmers to find solutions like this. We just need to make sure it actually works and provides value to the farmer.”

Field trial participants included Devin Hartzler, a Carstairs area farmer and AWC region 2 director. Utrisha N was trialled on his farm. “Every time I’ve tried anything, it has not worked,” said Hartzler. “I’ve been skeptical, but I like trying things because I like to know for myself.” Although the trial results showed no measurable difference in yield, Hartzler said he’s still somewhat hopeful and added he’s curious to hear the results of field trials conducted by agronomist Craig Shand.

Shand, owner of Chinook Agronomics, conducted trials with clients in Central Alberta, none of which were randomized or replicated. In 2021, one of Shand’s customers devoted 80 acres of a quarter-section of CWRS to Utrisha N and left the remainder of the field untreated. Shand ensured the farmer did not tank mix the product with herbicides, as he wanted to eliminate possible detrimental effects to its living components. Because it was a drought year, wheat yields were lower than expected. Visually speaking, there were no differences between the treated and untreated crop right through the season. Tissue samples taken from both treated and untreated field areas also showed no significant differences.

However, when Shand pulled the calibrated yield data from the combines and layered it with the as-applied data from the sprayer, the Utrisha N treatment did 55.3 bu/ac and the untreated did 51.2 bu/ac acre—a 4.1 bu/ac bump. There was no significant difference in protein between treated and untreated grain samples.

In 2022, two of Shand’s clients applied Envita on 80 acres and Utrisha N on 40 acres, alongside untreated checks, one in canola and one in CWRS. No visible differences were observed in canola, although yield data has yet to be analyzed.

The Envita wheat trial, however, produced intriguing results. According to Shand, within two weeks of application there were visible differences between the treated and untreated plots. “The [Envita treated] crop was greener, and it was slightly taller and lusher than the untreated check,” said Shand. There were no visible differences in the plants treated with Utrisha N, though Shand has not yet analyzed the yield data.

“Like everybody else you’re talking to, I’m skeptical,” he said. “We’re going to have to look at more trials and more data before we make decisions on whether this is something our clients are going to implement on their farms. But it’s something we’re looking at with great interest.”

Gurbir Dhillon, a research scientist with Farming Smarter, is wrapping up a three-year trial in which he compared traditional fertilizer inputs based on soil test recommendations with supplementary biostimulant packages that included Alpine, ATP, Penergetic and Stoller. Treatments were evaluated for their effect on crop growth and yield in wheat, field pea and canola. A further treatment included application of seed treatment, plant growth regulators and fungicide along with traditional fertilizer inputs.

Experimental trials were conducted at Lethbridge (Farming Smarter), Falher (SARDA Ag Research) and Forestburg (Battle River Research Group) locations across brown, grey and black soil zones in Alberta. Six site years of data were obtained for each crop in 2020 and 2021. Data was collected for various growth and yield parameters and is now being compiled for statistical analysis.

In the first two years, Dhillon saw a three- to five-bu yield increase in peas. At two of the sites, 2022 data shows a significant 10- to 15-bu yield increase in peas with an Alpine treatment. Penergetic and Stoller plots also saw a yield boost, but not as high as Alpine.

Yield increase in wheat was only observed in one of the six site years. “In general, we did not see much of a difference in wheat, but then we have to take into account there was also pretty bad drought in 2021,” said Dhillon. “Overall, the yields were pretty low, so it is possible the moisture was limiting.”

Data for the 2022 trials has not yet been analyzed, but Dhillon is curious to see if there was an effect, as crops received a decent amount of moisture. Although the study is now complete, Dhillon said he hopes to continue it in the future. “There was a fair bit of interest from producers, and we did see some positive results,” he said.

FARMERS WEIGH IN

Crop nutrition comes first, said Darold Niwa, a durum and lentil farmer in the Medicine Hat area, in a Twitter conversation on the use of biostimulants. While he has used and tested biostimulants on his farm, he admitted repeatability and trial consistency are challenging.

A trained agronomist, Niwa has worked with biostimulants while employed by BASF and UFA. He looks for two factors when he chooses a product for his own use. “I look for a product that works on a molecular level within the epigenetics of the plant,” he said. He also ensures the product contains constituents or metabolites such as glutamic acid or jasmonic acid. “There is biochemistry that [they] perform within a plant that I know are repeatable and positive,” he said. “But if you don’t get macronutrients really balanced and correct in a plant, no biostimulant will ever, ever work because the nutrition is wrong,” he added. Niwa also advises biostimulant users to consider application timing that is suited to the plant’s needs rather than simply convenient for the farmer.

Taylor Snyder farms 1,200 acres near Bonnyville with his father and brother. He said they have tried a variety of biostimulant products. Snyder’s grandfather started to use them 20 years ago when the farm had a serious grasshopper problem. After using biologicals, he found he no longer had to spray for insects. In fact, he hasn’t sprayed insecticides in nine years. This was a turning point, and Snyder hasn’t looked back. “We’re quite happy with them,” said Snyder. He admitted, though, he’s not good at setting up replicated trials. “A lot of times if it seems like it works, then we’ll try it some more. And if it still seems to be working, then we’ll use it.”

ON-FARM TRIALS THE RIGHT WAY

Jason Trowbridge is an independent agronomist with Growise Agronomy in Lethbridge. He has used biostimulants since he was a teen. Like Niwa, he said the effects are difficult to assess, especially if you don’t get basic nutrition right. Still, he believes in them.

“The market is flooded with several categories from actual stimulants to live biology to hormones, all working slightly differently,” he said. “It cannot be boiled down to this product on that crop works great. It is about understanding the impact each will have, and are they necessary in your situation.” Is the product compatible with how the farmer intends to apply it?

Trowbridge recommends farmers start with a soil test. Once a biostimulant has been selected, it’s important to cut out products that could potentially kill the added biology.

Field scale trials need to be half and half, said Trowbridge. Choose a field that’s representative of your farm’s average conditions and divide it in two. Apply the biostimulant to one half and seed as normal on the other half. If you plan to use fungicides, herbicides and pesticides, apply as normal across both plots.

For clear results, Trowbridge also advises farmers to stick with one product at a time rather than test combinations. Use a product that suits the intended outcome. For example, a micronutrient is not necessary if your soil already contains adequate micronutrients, he said.

Conduct a soil test before and after the trial to measure harvest parameters, including yield, quality, test weight and proteins, said Trowbridge. Dial back your expectations and don’t draw conclusions from the combine monitor. “If you’re going to do a trial, give it a fair trial,” he added. “Don’t expect to see 10 per cent. There isn’t a product out there that will give you 10 per cent. We’re looking for small gains, because guys are already doing a pretty good job at what they’re doing.”

Trowbridge is excited about the future of biologicals, but remains skeptical commercial products will deliver the best results. “Biology is probably the key to our next agricultural breakthrough, but I don’t think it’s going to be a commercial product,” he said. “I think it’s going to be understanding the biology that’s in the soil and learning how to treat it properly and not kill it.”

Comments