Winter

2018

Grains

West

30

While most of the anti-avoidance

rule changes impacted farmers with

corporations, one change could have

greatly affected unincorporated farms.

“Under the proposal, if you transferred

land to a child and they later sold it,

their capital gains exemption would be

reduced by however much the land

appreciated from the time you first

purchased it to when that child turned

18,” said Good. “So, if you bought

land in 1975, sold it to your 18-year-old

daughter in 2017 and she sold it 10

years later, all the gain in land value from

’75 to 2017 would come off her capital

gains exemption.” Since that gain could

represent 90 per cent of the exemption,

the reason for concern was clear.

Perhaps anticipating some of these

objections, the government provided

a 75-day consultation period—which

ended Oct. 2, 2017—to gather taxpayer

feedback on the proposed changes.

That’s when a potential bad-news story

for agriculture took a turn for the better.

Commodity organizations and individual

farmers from across the country voiced

concerns with the proposals and, more

importantly, had their voices heard.

“Right away, we met with the Prime

Minister’s Office and the Department

of Finance Canada,” said Bonnett. “We

also joined with other groups to have (tax

and legal consultant) MNP evaluate the

impact of the changes and give us hard

numbers to support our position.”

When the smoke cleared from all of the

meetings, phone calls and emails, most in

agriculture liked what they saw.

It began with Ottawa saying it would

move forward on an election pledge to

lower the small business tax rate to nine

per cent from 10.5 per cent by 2019, but it

certainly didn’t end there.

“Proposed rules to discourage using

corporations for passive investing will

move forward, but a new threshold will

allow $50,000 in income a year to be

exempt from the new higher tax,” said

Good.

So, assuming you earn a three per cent

return on your investments, you could

have $1.6 million in cash in your company

and not have it taxed as passive income.

“That’s a lot of cash to have around for

buyingmachinery or your next quarter-

section, which alleviates a lot of worries

we had as a resource-based industry,”

said Good. However, the active farm asset

test remains in place, requiring no more

than 10 per cent of all assets owned by the

company remain inactive. Failing this, said

Good, the company is “offside” for the

family farm rollover and the capital gains

exemption when transferring shares.

The government also pulled the

proposed limit to the capital gains

exemption, meaning children can

once again sell land purchased from a

parent with no risk of their capital gains

exemption being reduced when they go

to sell it themselves. A holding rule also

remains in place, prohibiting the sale of

land for three years after its transfer.

Perhaps of greatest relief to many

farmers is the nixing of the surplus

stripping rules. “There’s no longer the

prospect of paying more tax when you

sell land to your offspring as opposed to a

stranger,” said Good. “That’s a huge deal

for the industry.”

And given what has transpired since

the initial announcement, Good said the

industry should take a collective bow.

“There has been almost a complete

reversal of tone from the government,”

said Good. “That’s a tribute to everyone

involved.”

Last but not least, Good recognized the

government for listening and responding

to industry concerns. “This is a feel-good

story on many levels. Usually we complain

and nothing happens, but this time

everything happened.”

From Bonnett’s perspective, this

saga showcased the value of farm

organizations like the Canadian

Federation of Agriculture that can pull

numbers together quickly and gain access

to decision-makers before it’s too late.

“It also shows you can have a strategic

plan for the next five or 10 years and then

suddenly have to scrap it and make a

new one,” said Bonnett. “To succeed at

anything you must be able to adapt, and

farmers are very good at that.”

Through all the ups and downs, many

observers say the industry showed its

true colours with perseverance and

teamwork. And in the process, it turned

what could have been a black mark on

business-government relations into a red-

letter day for all concerned.

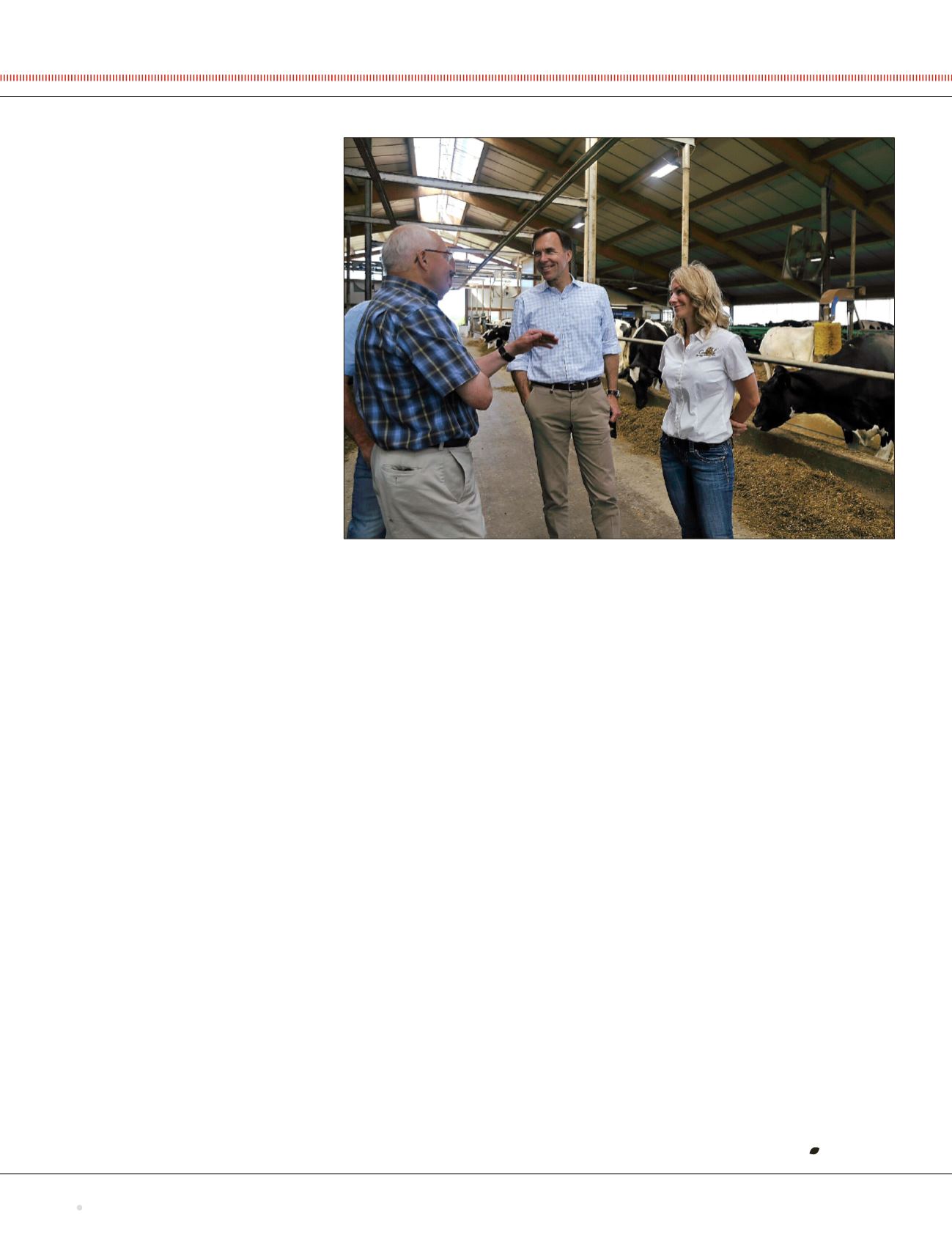

Federal FinanceMinister Bill Morneau, left, during a visit to Crasdale Farms in South Rustico, P.E.I.