Winter

2018

grainswest.com29

$1 of earned income. When you’re paying half a million dollars

for a combine, you need a rainy-day fund from passive income

to make a reasonable down payment. Equating farmers to

professionals who just pay office rent is a classic case of apples

and oranges.”

One of the most concerning proposals for many in agriculture

related to succession planning. This

change, which Good said impacted

incorporated farmers, related to the anti-

avoidance rule and something called

“surplus stripping.”

“For the first 40 years of their lives,

farmers sacrifice income to create capital

wealth,” said Good. “When they retire,

they want to convert that capital wealth

into income using the capital gains

exemption. Since a farmer doesn’t have

a company-paid pension plan, this is the best option for funding

their retirement.”

Using the example of someone selling a quarter-section of

land to his or her company for $500,000 to claim the capital

gains exemption, Good explained the problemwhen tax

changes prohibit that practice: “Under the new rules, that

$500,000 would have been taxed as a deemed dividend at up

to 36 per cent even if I sold the land to my incorporated son or

daughter, as many farmers are inclined to do. But if I sold it to a

neighbour or complete stranger, I [would have] paid no tax.”

Ron Bonnett, president of the Canadian Federation of

Agriculture, shares Good’s concern about altering succession

rules. “This change could be where farmers [would have felt]

the most impact,” he said. “If you can’t

take full advantage of the capital gains

exemption for transferring your business

to the next generation, you may not have

enough money to retire and your son or

daughter will have to pay more for the

operation. So, it’s really a double whammy

affecting both buyer and seller.”

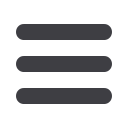

For Alberta Barley board member

Dave Bishop, who farms near Barons,

this change epitomized what was wrong

with the proposal and the process. “I’ve invested a lot of time

and money in succession planning so I can pass the farm to my

sons, and I did that based on the provisions of the Income Tax

Act,” he said. “If they were to change key elements of the act

without considering all the consequences, how could I plan

for the future and play by the rules when I don’t know what

they are?”

“In farming, it takes at least

$9 to $11 of capital to create

$1 of earned income.”

–Merle Good

Canadian Federation of Agriculture president Ron Bonnett believes the alteration of the proposed federal tax changes illustrates the value of farmorganizations as industry

advocates.