Spring

2016

grainswest.com

33

of Beer Canada. “With all of the interest in beer today, the

opportunity is there for brewers to trumpet the significant

benefits a successful beer category brings to communities

across the country.”

In an industry where international brewing companies

dominate production, distribution and marketing, the growing

demand for craft beer is persistent and disruptive. A 2015

report on liquor sales in Canadian restaurants found that,

while overall beer consumption declined by six per cent, craft

beer servings increased by seven per cent. Furthermore, craft

and microbrew beers now account for 17 per cent of all beer

at casual dining restaurants, according to market research

company NPD Group.

“Craft breweries raise the bar for beer,” Sherman said. “Once

you start down the path of enjoying craft beer, it’s an awakening

to what the possibilities are. You want more—more exciting,

more interesting beers—and never turn back.”

The unique flavour profiles and small-batch brewing that

characterize craft beer are difficult for the established large

breweries to reproduce.

“Not only is the average palate of beer drinkers becoming

more sophisticated, but the big breweries realize that there’s no

way for them to try to produce the same level of product in their

huge systems,” Sherman said. “The only other option for them

is to buy the craft breweries because every day they are losing

market share to craft beer.”

DIFFERENT PROCESS, DIFFERENT MALT PROFILE

The Crop Development Centre at the University of

Saskatchewan has been involved in malt barley breeding for

the past four decades. Over the years, it has targeted different

markets, including a significant focus on malting profiles catered

to larger brewers.

According to Aaron Beattie, oat and barley breeder at the

Crop Development Centre, he and his team have recently

started to focus more on the needs of the craft industry.

“Typically, the biggest difference between the larger brewers

and the craft industry is that craft brewers are making all-malt

beer where the barley malt is the only contributor to alcohol

content of that beer, as opposed to other sources of starch like

rice or corn,” Beattie explained.

“Where the enzymes in barley are responsible for breaking

down the starch into simple sugars in other grains, it means the

enzyme level in the barley malt has to be quite high. If all you are

using is barley malt, the enzyme levels don’t have to be that high.”

Canadian brewers source more than 300,000 metric tonnes

of malting barley fromWestern Canada annually. While craft

brewers only produce six per cent of the total volume of beer

nationally, they can use up to 25 per cent of domestic malt

barley in their brews. Craft brewers may not be a major driver in

new variety development yet, but their willingness to work with

new varieties could help create a market for them.

In 2015, AC Metcalfe and CDC Copeland accounted for 74

per cent of the total seeded acres of malt barley planted on

the Prairies.

“One good thing about the barley industry in general is there

is good communication between brewers, maltsters, growers

and breeders,” Beattie said. “Growers are looking for a change

in the varieties to get off of Copeland and Metcalfe, but they are

looking for a consistent signal that some of the new varieties will

be bought.”

From an agronomic perspective, Beattie is aiming for the

same set of traits across the board—increased yield, good

lodging tolerance, and resistance to fusarium head blight and

leaf diseases like scald, spot blotch and net blotch.

“AAC Synergy, CDC Kindersley and CDCMeredith are

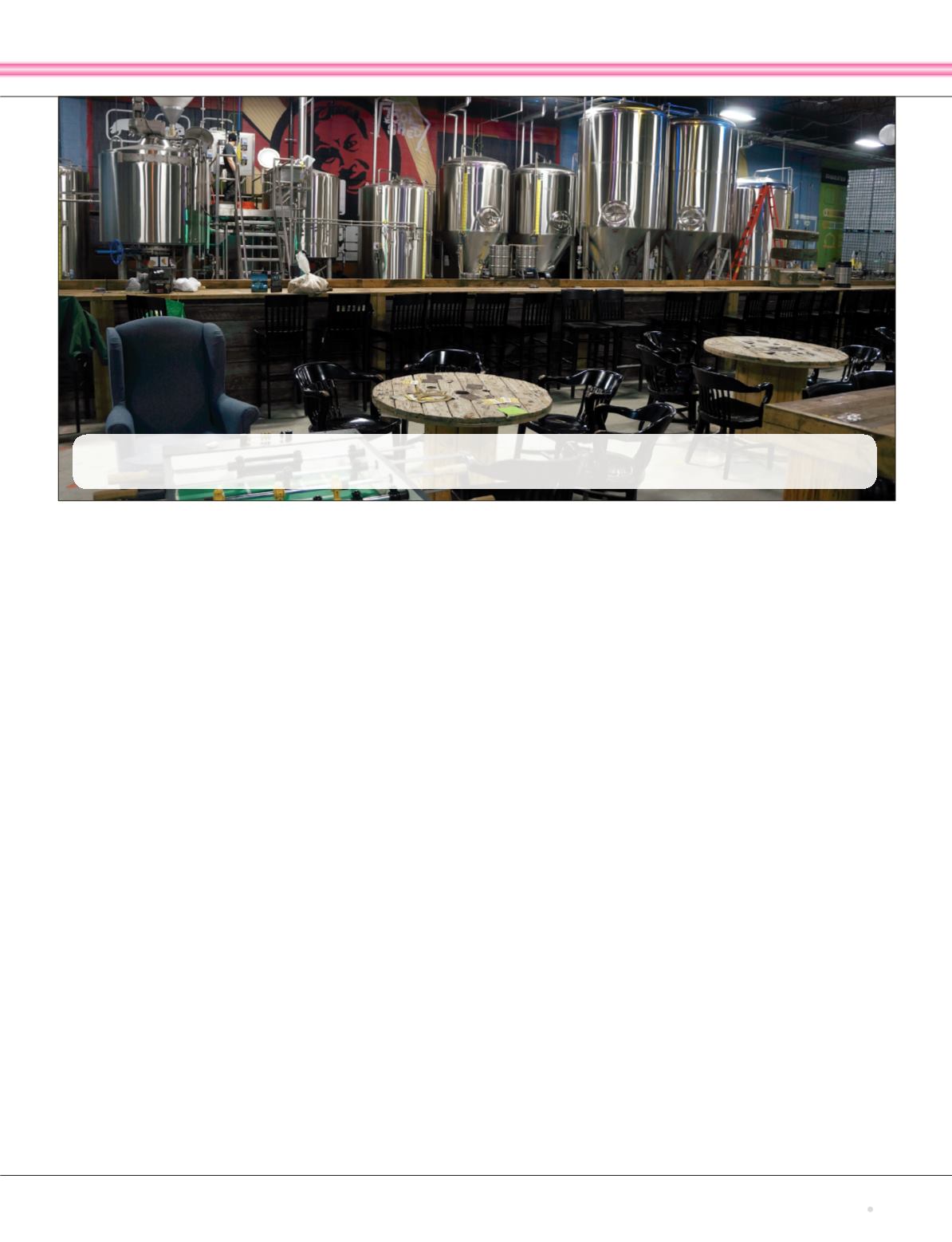

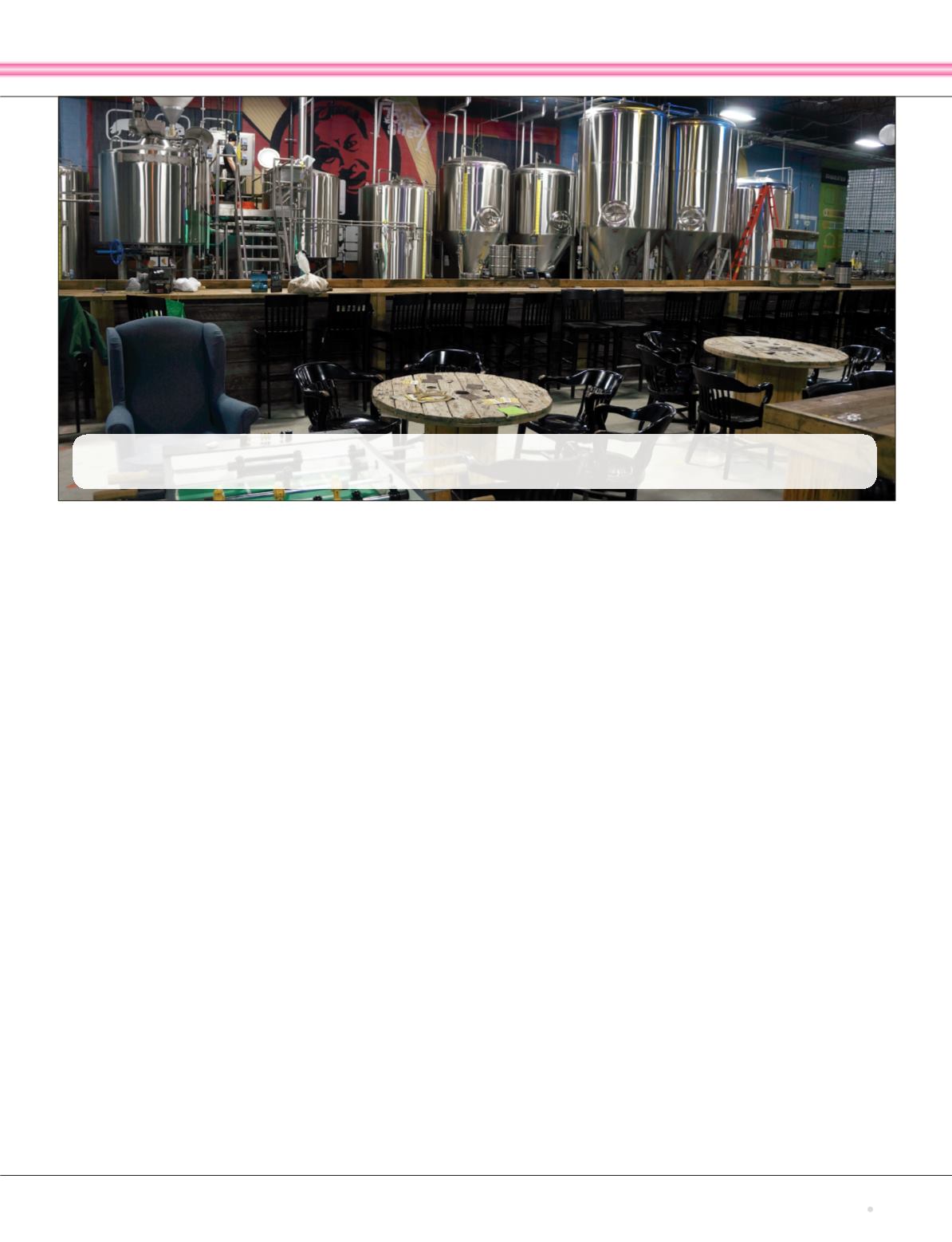

HOW THE SAUSAGE GETS MADE:

At Tool Shed, you can enjoy a frosty pint in the brewery’s tasting room while you watch Alberta malt become

beer right before your eyes—emphasizing the connection between the ingredients and the final product.