Spring

2016

grainswest.com

23

some of them are very large. Minneapolis-St. Paul-based CHS

is a $44-billion business. Its members and affiliates throughout

the Great Plains (these are local grain handlers and suppliers of

fertilizers and chemicals) are also very large.

“Thus co-ops can and do operate on a very large scale. A

number of authors have argued that traditional co-ops have to

change—they cannot operate on the scale required with what

might be called the standard co-op structure. However, there

does not appear to be any one single model for this alternative

structure.

“In the United States, for example, co-ops have evolved in a

number of different ways. Nor is there any requirement that they

have to move to an investor-owned (or publicly traded) model—

again, the experience in the United States is that co-ops have

remained strong as co-operatives.”

Similarly, some of Fulton’s colleagues at the Centre for the

Study of Co-operatives agree that co-operatives can be a very

effective model for large or small businesses, although they do

face challenges.

“As the business or the co-operative gets bigger and more

complicated, it becomes a test of their governance,” said Brett

Fairbairn, acting director at the Centre. “We’re seeing today

where these co-operatives are managed by boards of directors

of experienced farmers who are well educated and trained in

leadership. What can this group of well-trained farmers bring to

the table?

“There are many good features of co-operatives as well

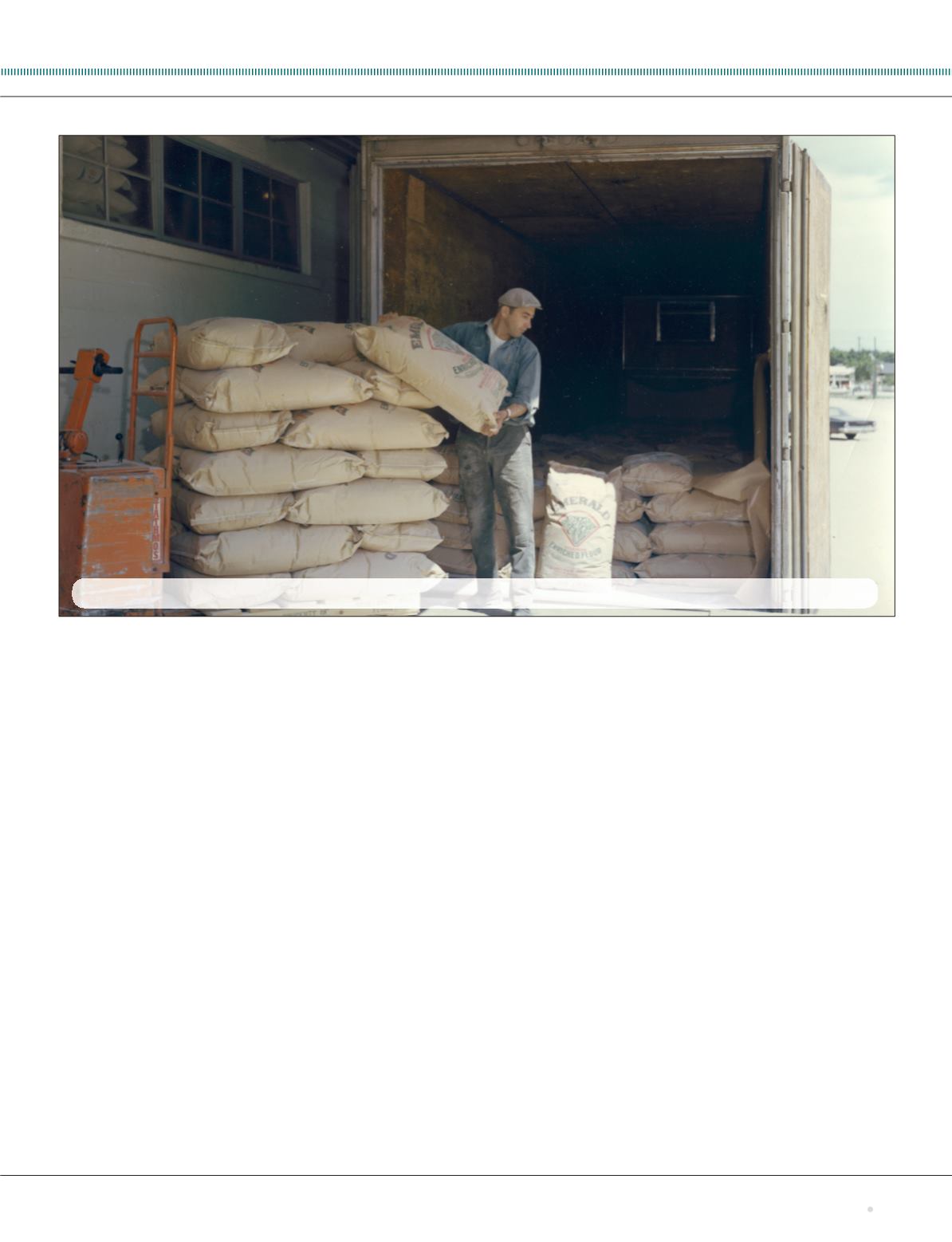

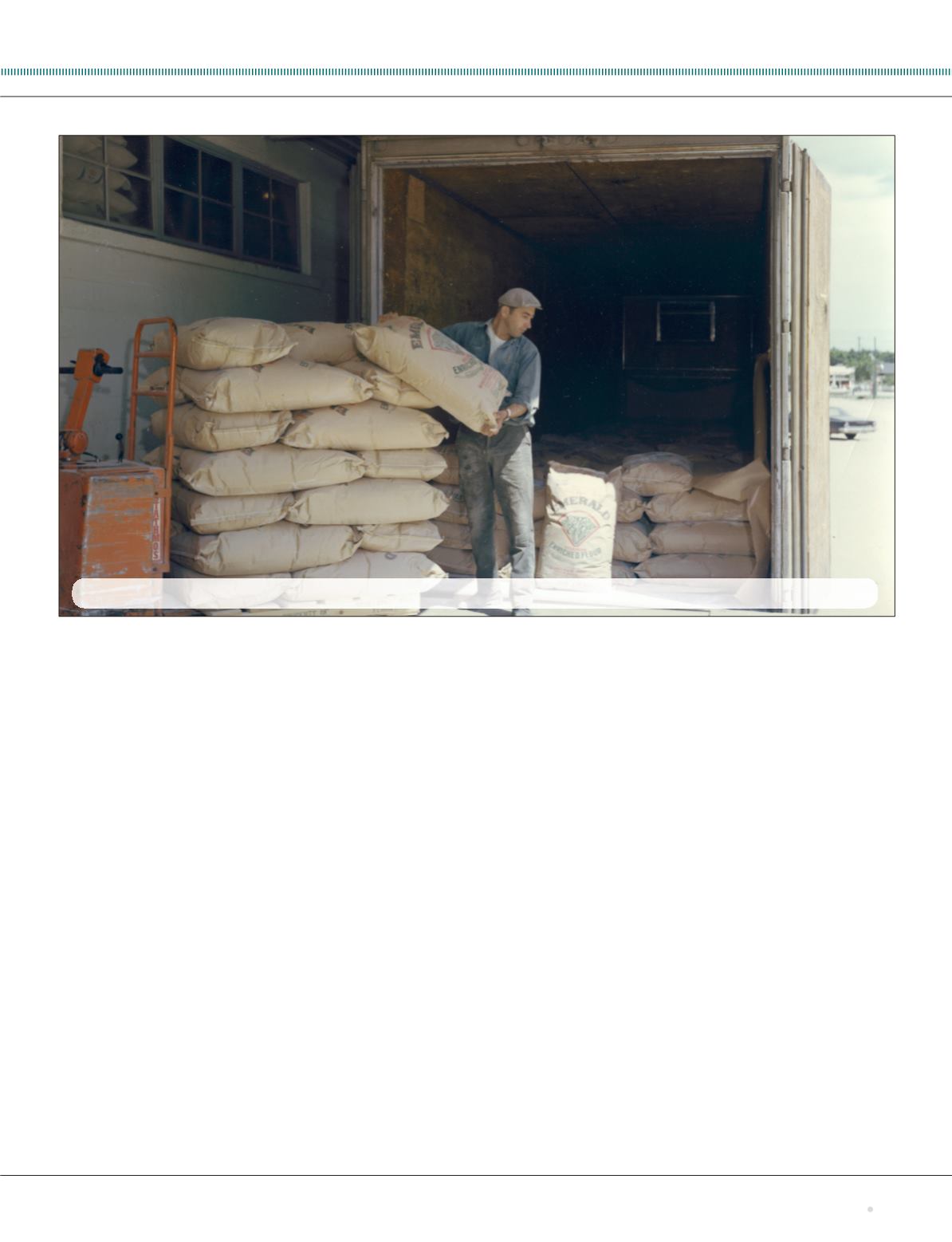

ON THE MOVE:

An employee of the Saskatchewan Wheat Pool loads bags of enriched flour onto a truck, ready to be sold in the marketplace.

as weaknesses. And the one main weakness we saw in the

Canadian Prairie grain co-ops was the ability of the board to

give direction and control management.”

Eric Micheels, an assistant professor in business and

economics at the University of Saskatchewan, said one feature

of the farmer-owned co-operative is the capacity for more

“patience capital.”

“With a publicly traded company, to some extent the

pressure is on to return dividends to the shareholders,”

Micheels said. “Whereas with a co-operative, as long as the

investment meets the goals of the co-operative, it can probably

be a bit more patient for the investment to pay off. The board

may be willing to wait a bit longer for the returns rather than

need that quick hit on returns.”

While there are successful agricultural co-operatives in

Western Canada, such as Federated Co-ops, American

co-operative CHS Inc., which is establishing retail outlets in

Canada, has developed a diversified multinational business

over its 85-year history.

It is all about providing good value and service to member-

owners, as well as returns over the long haul, said Lynden

Johnson, CHS executive vice-president, country operations.

“In the agriculture industry it is very difficult to get that quick

return on a quarterly basis as is often demanded by publicly

traded companies,” Johnson said. “Our owners are farmers—

family farms. They know they are getting value and service, and

they know in the cyclical world of agriculture the returns are