Winter

2017

Grains

West

20

“The key thing on the carbon tax is

that B.C. farmers support initiatives to

reduce climate change. Our farmers

are impacted by climate change more

than any other group in society. We

have a vested interest in making things

better,” he said.

The BCAC fundamentally disagrees

with the B.C. government’s claim that

the carbon tax is revenue neutral. The

organization claims that the carbon

tax goes into general revenue, and

has been used to lower income tax

and fund some social programs. The

BCAC would like to see a reinvestment

strategy for revenue generated by

the climate tax to support climate

mitigation, adaptation, research and

innovation that will help the industry

adapt to climate change impacts and

reduce emissions.

“A carbon tax is an input tax. Income

tax is paid when you have a successful

year. Input taxes can affect cash flow

and make it more challenging because

if farmers have a bad year, they still have

to pay the tax,” said Ens.

pressUre from feds increAses

UncertAinty

In October 2016, the federal

government raised the stakes for the

provinces to deliver on their greenhouse

gas emission reduction goals by

announcing that a federal carbon price

will be imposed on all provinces that do

not already have a carbon price or cap-

and-trade system in place by 2018.

Prime Minister Justin Trudeau

announced that carbon pricing should

start at a minimum of $10 per tonne

of carbon dioxide emissions in 2018,

and be increased by $10 each year

to $50 a tonne by 2022. While the

announcement sent a clear message

on federal priorities to the provinces,

it only added to the uncertainty in the

agriculture sector around climate policy.

Levi Wood is president of the Western

Canadian Wheat Growers Association,

and farms in Pense, SK. He said the

federal announcement will be cause for

concern until the specific deadlines are

determined and shared.

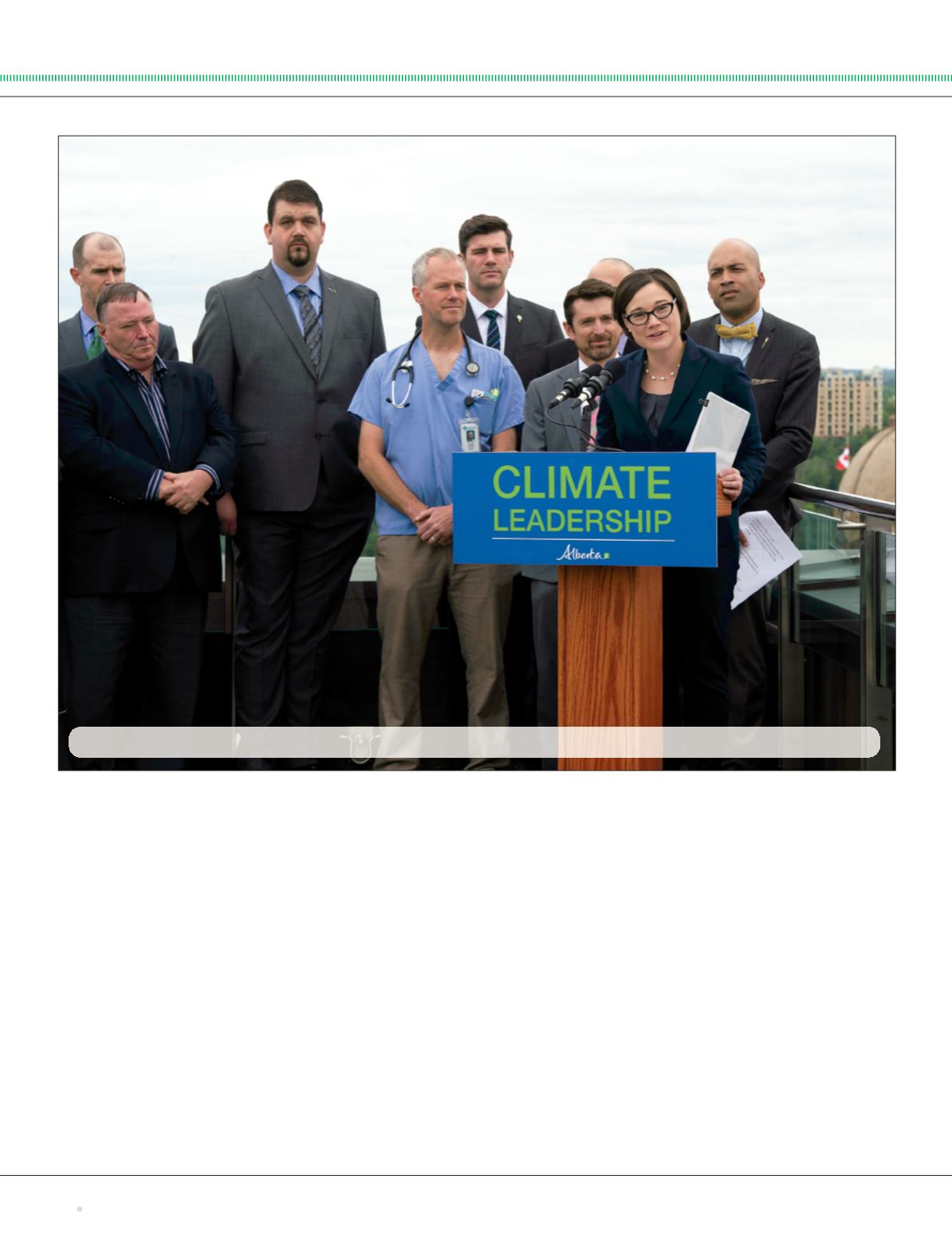

LEADING THE CHARGE:

Alberta Environment and Parks Minister Shannon Phillips introducing the Climate Leadership Implementation Act.