Fall

2015

Grains

West

8

BY TAMARA LEIGH

THE

FARMGATE

G3EXPANDSEXPORTPOTENTIAL

PLANS FORANEWTERMINALCOULDOPENUP EASTERNMARKETS

WITH THE REBRANDING OF THE

Canadian Wheat Board complete, G3

Canada Limited has announced expan-

sion plans that will solidify its network

in the East and create a new, more robust

grain-transportation corridor to the West.

The investment, including the devel-

opment of a new grain terminal at Port

Metro Vancouver, is expected to ease the

bottleneck of moving grain to new mar-

kets, including Asia and the Middle East.

“We are currently looking at the feasibil-

ity of building a facility in North Vancou-

ver on a piece of land that we feel is one of

the best, and possibly last, deep-water port

sites in Vancouver,” said Karl Gerrand,

chief executive officer of G3. “If we are

successful, it will be the first new grain

terminal built in Canada since the late

1960s and a complete step change from the

way things are currently done.”

Plans for the terminal include a loop

track with the capacity to have three

130-car unit trains on site at a time and

to unload a unit train in less than six

hours. The new terminal will increase

efficiency, alleviate the current bottleneck

and create capacity for third-party grain

shipments to international markets such

as Saudi Arabia.

To support the new terminal, G3 is

planning to build six to eight inland

terminals in Alberta and Saskatchewan.

Locations have yet to be announced.

“Our target throughput for the new

[Vancouver] facility will be six million

tonnes per year. We expect to do four mil-

lion tonnes ourselves, and the other two

million will be available to other compa-

nies,” said Gerrand.

That additional capacity is music to

the ears of Nicole Rogers of Agriprocity, a

company that specializes in matching Ca-

nadian grain growers with contracts from

processors in the Middle East. “For us, the

G3 expansion means we’ll have an exit in

Vancouver,” said Rogers. “With the new

terminal, they’ll probably be more open to

a longer-term handling agreement, some-

thing our buyers in the Gulf are looking

for. The inland grain companies have no

motivation to do that.

“What’s great about having a Gulf entity

own bricks and mortar in Canada is that

[its] focus is the exact same as [that of] our

buyers,” added Rogers.

SALIC, the Saudi Agriculture & Live-

stock Investment Corporation, is a partner

in G3, along with Bunge Canada. Owned

by the Saudi government, SALIC invests

in agricultural, livestock and associated

value chains around the world to help

improve food security.

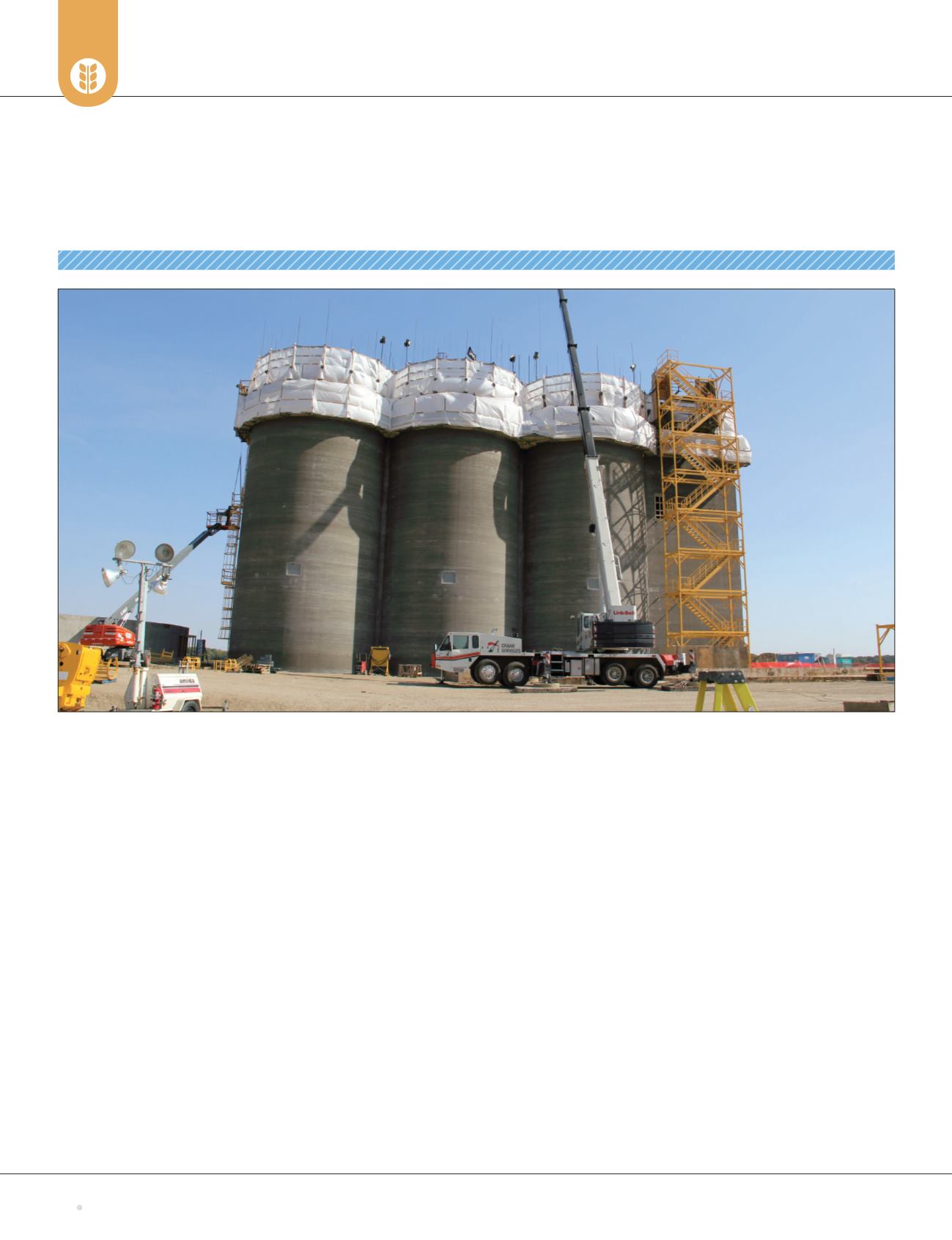

Construction proceeds at G3’s inland terminal in Bloom, MB.

Photo:G3CanadaLtd.